Despite being severely impacted by a major mine accident, Codelco, the world's largest copper producer, has clearly stated that its copper production in 2025 and 2026 will be slightly higher than that in 2024. This confidence stems from its multi-dimensional strategic planning and adjustment capabilities.

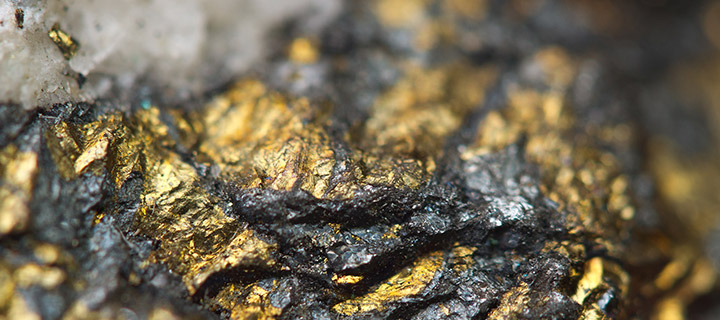

In late July 2025, a fatal rockburst occurred at El Teniente, Codelco's flagship asset and the world's largest underground copper mine. This mine produced 356,000 tons in 2024 and was the company's most profitable mine. The production loss due to the accident has since been revised upwards by 45% from the initial estimate of 33,000 tons, resulting in a full-year production reduction of 48,000 tons and a loss of approximately USD 500 million in EBITDA. Company executives acknowledged that the impact will extend over several years.

Despite the setback at its core mine, capacity expansion from other mines has compensated. The Ministro Hales mine and the Rajo Inca project at the Salvador mine contributed to increased production in the first half of the year and continued their positive performance in the second half. Through internal capacity adjustments, these assets compensated for the production shortfall at El Teniente, becoming the core cornerstone for maintaining Codelco's production targets.

Codelco's confidence stems from its long-term strategy and technological empowerment. In April 2025, the company partnered with Adani Group, the world's largest single copper smelter in India, to supply copper concentrate and expand into the Asian market, opening up sales channels for future output. Simultaneously, the company is advancing automation at the El Teniente copper mine and extending the life of the Chuquicamata copper mine through block caving, which is expected to increase production by 100,000 tons in 2025, supporting continued output growth.

As a Chilean state-owned giant, Codelco controls seven mines and 42.73 million metric tons of copper resources. In 2024, it reclaimed its position as the world's number one producer with 1.44 million tons of output. Although the Bank of Montreal has noted that Codelco is among the world's most indebted large mining companies and faces challenges such as declining ore grades, the company is mitigating these risks through public-private partnerships and plans to reach 1.8 million tons of production by 2030, demonstrating a clear long-term growth blueprint.

While this accident caused a temporary blow, the losses remain manageable within the broader context of Codelco's business. With its diversified mining operations, technological upgrades, and market expansion, Codelco's production growth expectations are well-founded. Behind its title as the "world's largest" lies the solid strength to cope with risks.